Memorandum with IMF: which tax is ready to be raised in Ukraine.

The Ukrainian authorities informed the IMF that they are ready to raise the value-added tax (VAT) if necessary. The Fund also considers VAT to be the main source of additional budget revenues.

The government letter states that currently, Ukraine's maneuverability within the framework of the current resource package is limited. Therefore, to ensure budget execution, they are considering the possibility of raising VAT as an effective source of additional revenues.

IMF experts emphasize that the budget process in Ukraine is taking place in complex and uncertain conditions. The recent tax package ensured the necessary increase in revenues, but is less than the initial project, which envisaged broader application of the military tax and other measures.

The current tax package project leaves smaller buffers in the 2025 budget, which complicates the absorption of potential shocks. Therefore, if unforeseen expenditure needs arise or revenues decrease, the authorities have committed to introducing additional tax measures, in particular, an increase in VAT, to preserve the deficit and compensate for the impact of the shock on the debt.

Fund experts believe that increasing the main VAT rate is the most reasonable, as it is effective, covers the informal sector, and is fully directed to the state budget.

Read also

- Iran retaliated against the US night strike by attacking Israel with missiles: what is known

- Syrskyi spoke about his attitude towards the appointment of Madiar as the commander of the Unmanned Systems Forces

- ISW explains Putin's goal in Ukraine

- The USA struck nuclear facilities in Iran: Trump announced 'total destruction'

- Enemy losses as of June 22, 2025 – General Staff of the Armed Forces of Ukraine

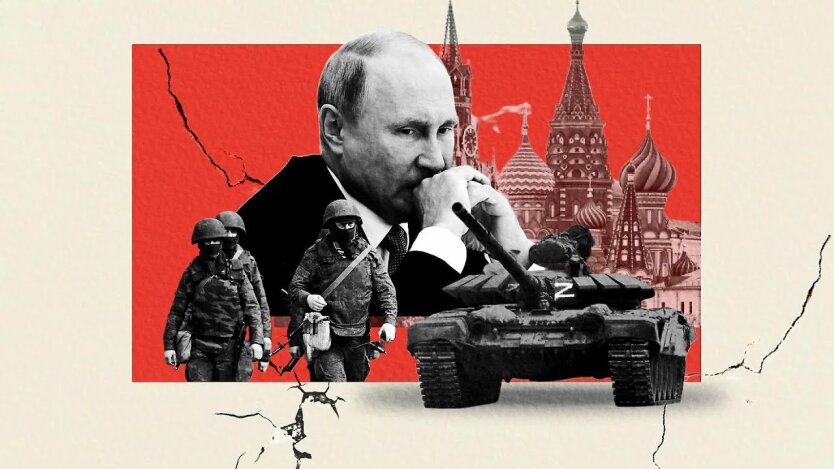

- The End of 'Peaceful' Rhetoric: What Putin's New Ultimatum Means for Ukraine and the World